What is a Personal Liability Insurance?

PLI covers personal injury, property damage and financial loss accidentally caused to third parties.

This also includes loss of keys and damage to rented properties.

Let our virtual assistant explain the insurance to you.

- Immediate worldwide cover from €10 to €50 million

- Loss of keys and repair of locking system

- Damage to rented properties even by small pets

- No deductible with „Premium“ tariff

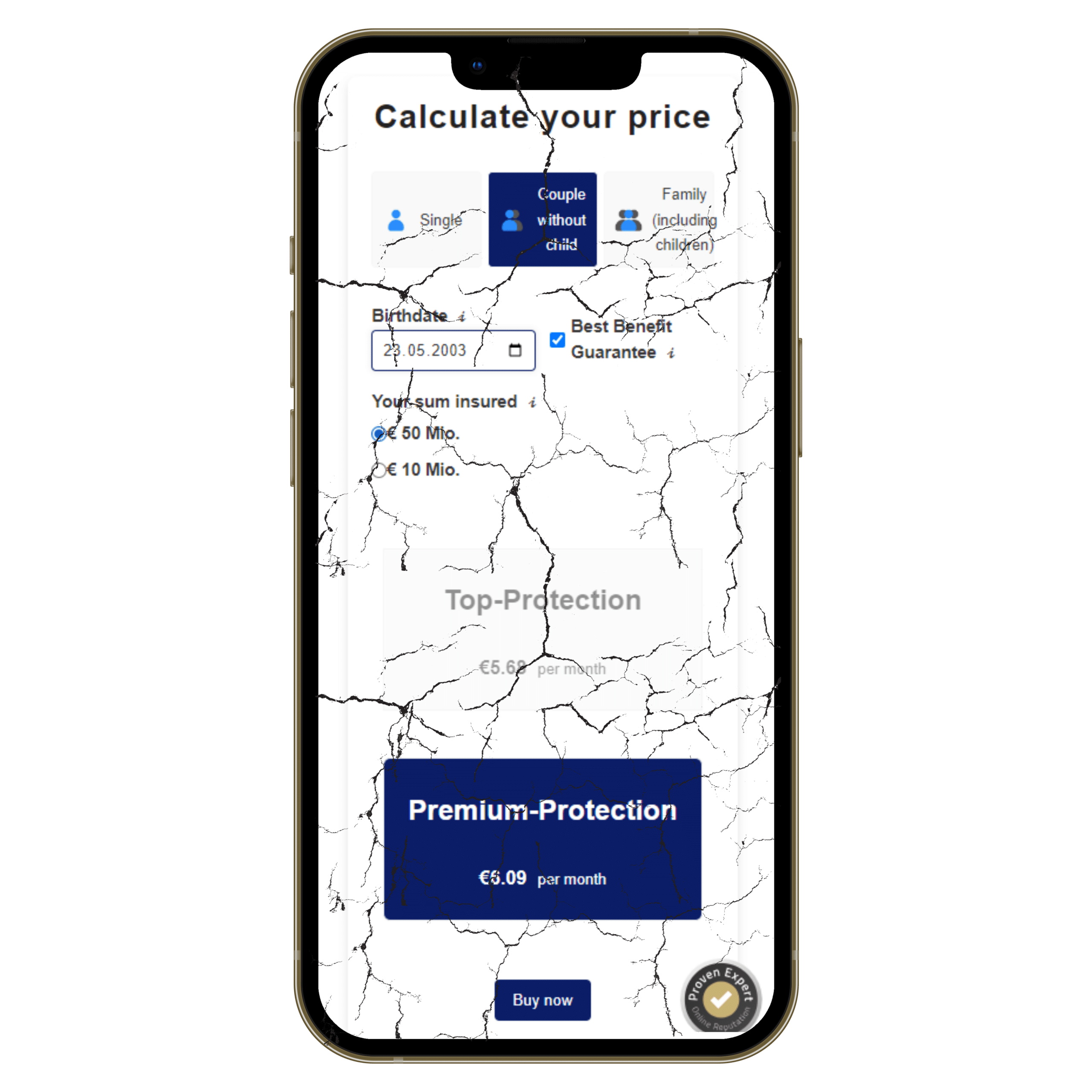

Calculate your price

Top- & Premium-Protection

- • Tax-deductible

- • Worldwide coverage

- • Discount for people over 50

- • Immediate cover and paperless policy

- • Daily termination right after the first year

- • Automatic inclusion of future condition improvements

Only with Premium-Protection:

- • New value compensation

- • Best Benefit Guarantee given by the insurer

- • 12-month contribution exemption in case of unemployment

Why CAPE?

Best pre-selected coverage

Choose one of the best tariffs on the market.

Easy claims settlement

Would you like to report a damage? Contact us. We will take care of it.

Personal support

Your personal advisor is always at your side.

What is covered?

Unintentional damage to others:

You spilt the good red wine on a friend's sofa

Loss of keys and codecards

(priv. & prof.):

You lost the keys of your landlord or your employer

Exercise sports / cycling:

You cause an accident while kite surfing or cycling

Rented flats or properties:

You caused a blocked toilet or your child has painted a wall

What is not covered?

Damage to your own belongings:

Damage to your own property or body is generally excluded

Glass breakage:

If you break a window or a plane glass

Mutual damage between co-insured persons:

If you iron your partner's shirt too hot

Damage as a businessperson:

If you as a businessperson cause damage to a customer

Listen to Nick

Let our virtual assistant Nick explain to you the personal liability insurance in detail:

Frequently asked questions

You can declare PLI in your tax return up to the maximum limit of 1,900 euros as a special expense. Please contact your tax advisor.

You have unintentionally injured a person. This includes physical impairments or psychological consequences.

You have unintentionally damaged, destroyed or lost someone else's property.

All losses that do not result in physical injury or property damage. For example, additional costs if the injured person misses their flight due to an accident.

PLI reimburses the current value, which corresponds to the new value of a product after deduction of wear and tear from the time of purchase. It is therefore lower than the new value.

No. A PLI is not a legal requirement, but it is highly advisable to conclude one. It protects you and your family from financial loss. Many landlords require proof of a PLI policy for the tenancy agreement.

It covers you if someone has caused damage to you but is financially unable to pay compensation. This is the case, for example, if the guilty party is insolvent and has no liability insurance.

Yes. In principle, all family members living in Germany are insured under the family tariff for one contribution. The details must be clarified.

Immediately from the requested start date. However, the date and an insured event must not be in the past.

PLI runs as long as you want. The term is automatically renewed until you cancel it. Any overpaid contributions will be refunded.

Don't worry. We assume and accompany the claim report to the insurer for you. Simply send us an e-mail or give us a call.

Yes and No: tame pets such as cats, birds, hamsters... are insured free of charge. Dogs, however, require their own pet owner's liability insurance.

Yes, you have a 14-day right of withdrawal without giving reasons and at no cost. Just let us know.